Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

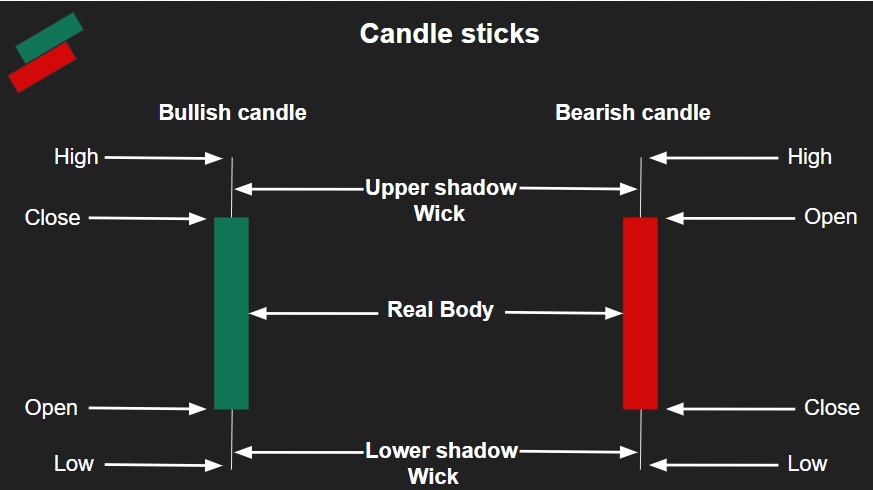

The candlestick consists of a ‘Real Body’. It is the rectangular section of the candlestick that depicts the range between the opening and closing price during the session. If the closing price is greater than the opening price, then the real body is represented in Green color. If the opening price is greater than the closing price, then the real body is represented in Red color. The candlestick also consists of the ‘Upper shadow’ and ‘Lower shadow’. The highest point of the upper shadow is the maximum price the stock touched during the session. The lowest point of the lower shadow is the minimum price the stock touched during the session. When the real body color is Green, it is known as a bullish candle, whereas, when the real body color is Red, it is known as a bearish candle.

The difference between the highest and the lowest price point on the candle is the total range in which the stock traded during the session.

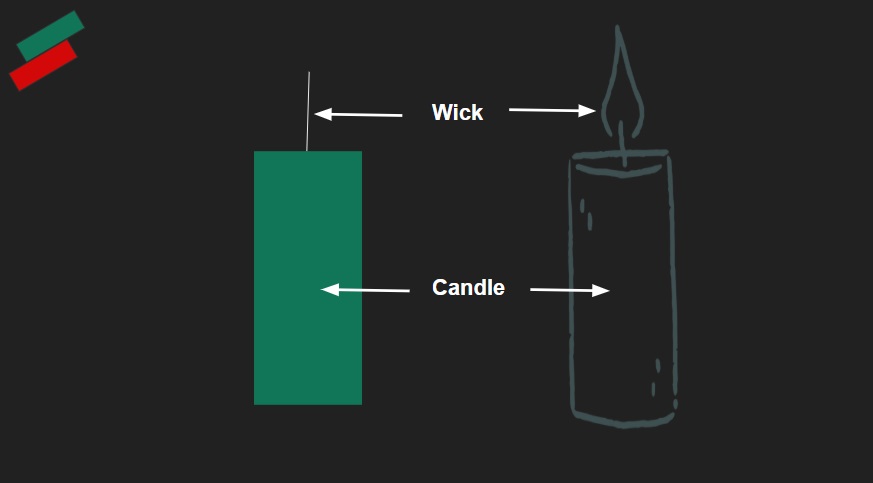

As in the case of real candle, the candlestick also consists of the real body and the wick (shadow).

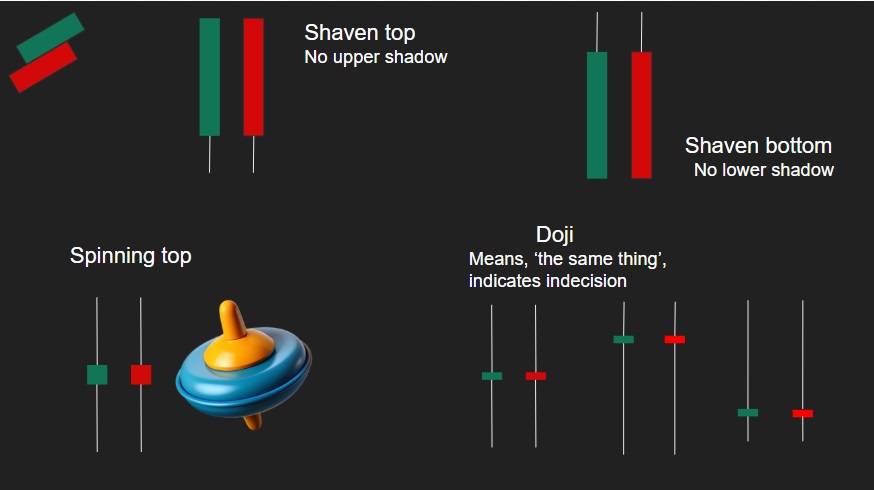

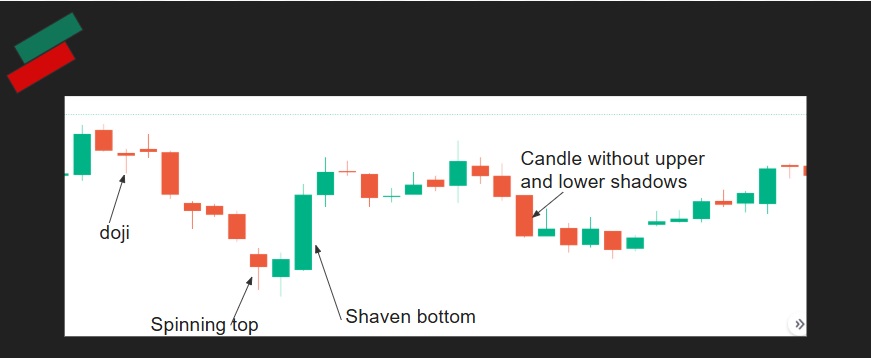

These are few examples of candlestick types.