Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

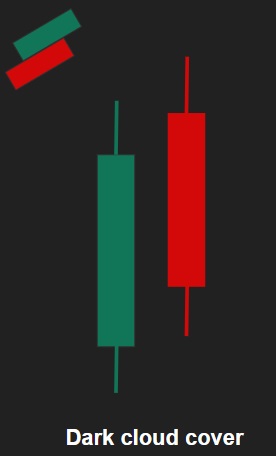

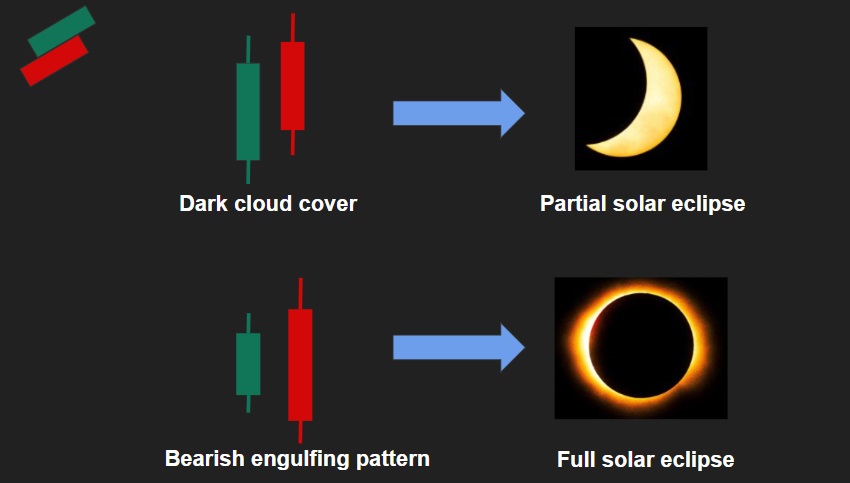

Dark cloud cover is a top reversal pattern. It is a two-candle formation. It indicates a reversal in the previous bullish uptrend. The first day candle of this two day formation is a large real body Green candle supporting the previous bullish trend. The second day candle opening price is above the previous day’s closing price, but by the time the session ends, the closing price of second day is well within the real body of the previous day candle. The second day is a Red candle that halts the previous bullish trend. This formation is of primary attention to a long term trader who would want to sell their previous bullish position on the stock whenever the dark cloud cover formation is discovered. It is also helpful for short term traders who sell their existing positions in stocks to buy short term positions in other stocks.

The depth of the penetration makes it comfortable for the traders to take clear decisions. If the second day Red candle penetration is more than 50%, then taking positions earlier becomes easy. But, if the penetration is less than 50%, traders would be better off awaiting the candle formation in the next 1-2 sessions before taking a position.

If the second day candle penetration is more than 100%, then it would form a bearish engulfing pattern.