Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

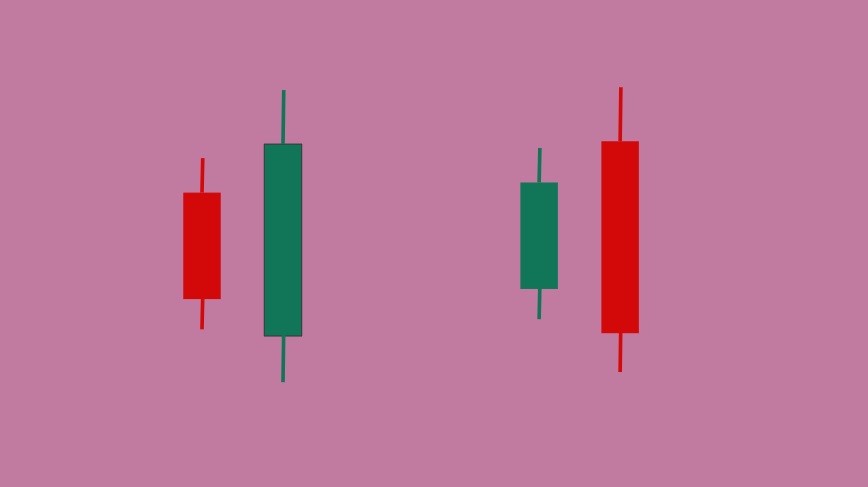

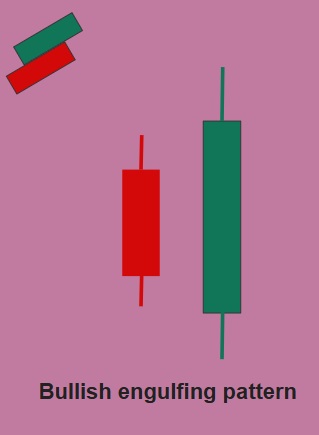

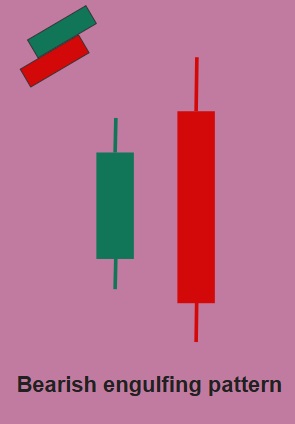

Engulfing pattern is a significant reversal formation involving two candles of opposite color. While hammer and hanging man are individual candle formations, engulfing pattern is a combination of individual candles. When the engulfing pattern is formed after a long downward trend (Bullish Engulfing) or after a long upward trend (Bearish Engulfing), then analysts make a serious note of these formations for their next strategy. The second candle’s real body should completely engulf or overshadow the real body of the first candle. In case of a bullish engulfing pattern, the second Green candle should engulf the first Red candle. For a bearish engulfing pattern, the second Red candle should engulf the first Green candle.

The small size of the first candle’s real body is crucial for the effectiveness of the engulfing pattern. The first candle can be a Spinning Top candle or best a Doji. Spinning top represents loss of previous momentum, whereas, Doji signifies loss in momentum and total indecision from market participants. At this point when there is a large real body candle formation of the opposite color, either at the top of an upward trend or at the bottom of a downward trend, it highlights a crucial reversal pattern. If the engulfing pattern formation is supported by large volume trades, then that augurs well for a potential reversal.

[…] If the second day candle penetration is more than 100%, then it would form a bearish engulfing pattern. […]

[…] If the second day candle penetration is more than 100%, then it would form a bullish engulfing pattern. […]