Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

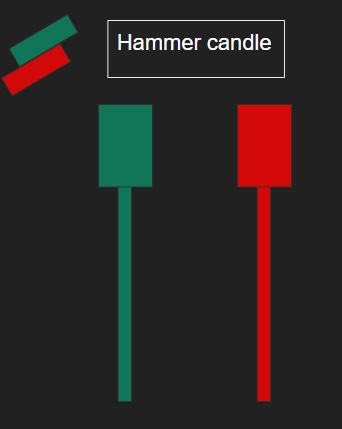

The hammer candle resembles an umbrella in shape. It is a type of spinning top candle formation. It has a small real body at the top of the candle followed by a long lower shadow. Hammer candle is a powerful reversal indicator if the formation happens after a long downtrend for a stock. It has bullish implications. The market tries to measure further depth of the fall, but can’t sustain at those levels due to forces pulling the price back to higher levels. There could be vital factors contributing to the strength of the stock at these instances. If this happens along with strong volume, then it bodes well for a possible reversal of the downtrend.

5 important points to note about the hammer candle:

Hammer candle is a crucial formation for a reversal after a long to very long downtrend in a stock. During the session, the bears tried their best to roll down the price further, but were confronted by positive sentiments in the market. The bulls then take control and pull the price significantly higher to close slightly higher or lower than the opening price. Hammer candle is not of much significance for a medium to long term investor if the formation happens after a short downtrend in the stock but could still be crucial for a short term (daily or weekly) trader.

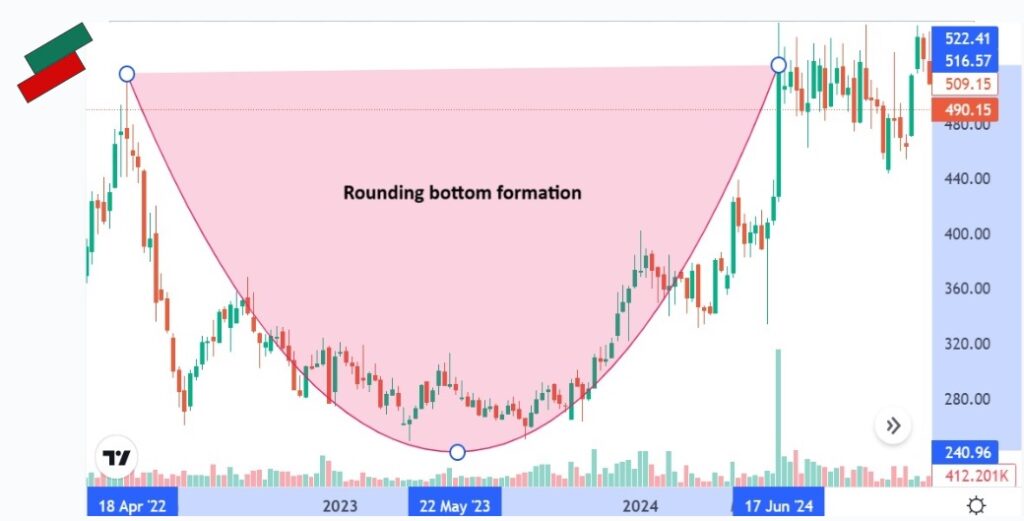

The above is a weekly price chart of Chambal Fertilisers Ltd. From 18’th April 2022, the price started to fall from the highs of ₹518 to ₹262 on 27’th June 2022. There was a slight reversal, but it kept falling later to find support at ₹248 on 27’th March 2023. Hammer candle was formed. The stock saw a reversal in downtrend from this point and currently trades at ₹490 after finding resistance at ₹550. A complete ‘Rounding Bottom’ was formed as shown in the below snapshot. The hammer formation happened after a substantial fall in price over one year period i.e. a fall of almost 52%. This was a strong indicator that the previous pessimism in the stock was losing steam and a trend reversal was on cards. It did happen and the stock price then saw an upward trend touching highs of ₹550 in the next one year period, an impressive 121% returns.