Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

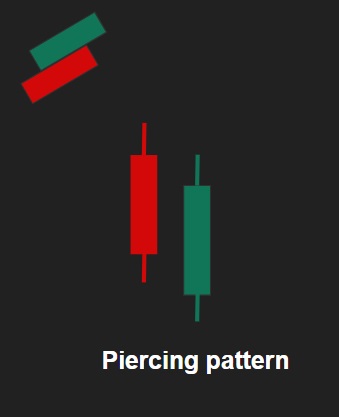

Piercing pattern is a bottom reversal pattern. It is a two-candle formation. It indicates a reversal in the previous bearish downtrend. The first day candle of this two day formation is a large real body Red candle supporting the previous bearish trend. The second day candle opening price is below the previous day’s closing price, but by the time the session ends, the closing price of second day is well into the real body of the previous day candle. The second day is a Green candle that halts the previous bearish trend. This formation is of primary attention to a long term trader who would want to sell their previous bearish position on the stock whenever the piercing formation is discovered. It is also helpful for short term traders who sell their existing positions in stocks to buy short term positions in other stocks.

The depth of the penetration makes it comfortable for the traders to take clear decisions. If the second day Green candle penetration is more than 50%, then taking positions earlier becomes easy. But, if the penetration is less than 50%, traders would be better off awaiting the candle formation in the next 1-2 sessions before taking a position.

If the second day candle penetration is more than 100%, then it would form a bullish engulfing pattern.