Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

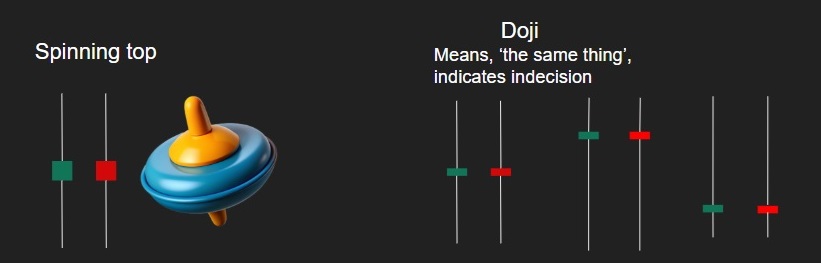

Technical analysts use the size of the candlestick’s real body to gauge the market’s momentum. Large size real body indicates thrust in one direction. Small size real body indicates loss of steam that could lead to possible reversals or difficulty in making further decisions. Small size real bodies either Green or Red are known as ‘Spinning top’ formation. Spinning top are components of multiple candlestick formations that are used to identify specific patterns in the market.

The size of the shadows in case of spinning top formation is not of much significance. The small size of the real body is paramount.

Some of the important candlestick formations where spinning tops are important components:

‘Doji’ is another variant of spinning top formation where the real body is tiny i.e. the opening price and closing price is extremely close to one another. Doji formation is a reversal signal for traders and they are extremely cautious when they witness this formation.

[…] real body is crucial for the effectiveness of the engulfing pattern. The first candle can be a Spinning Top candle or best a […]